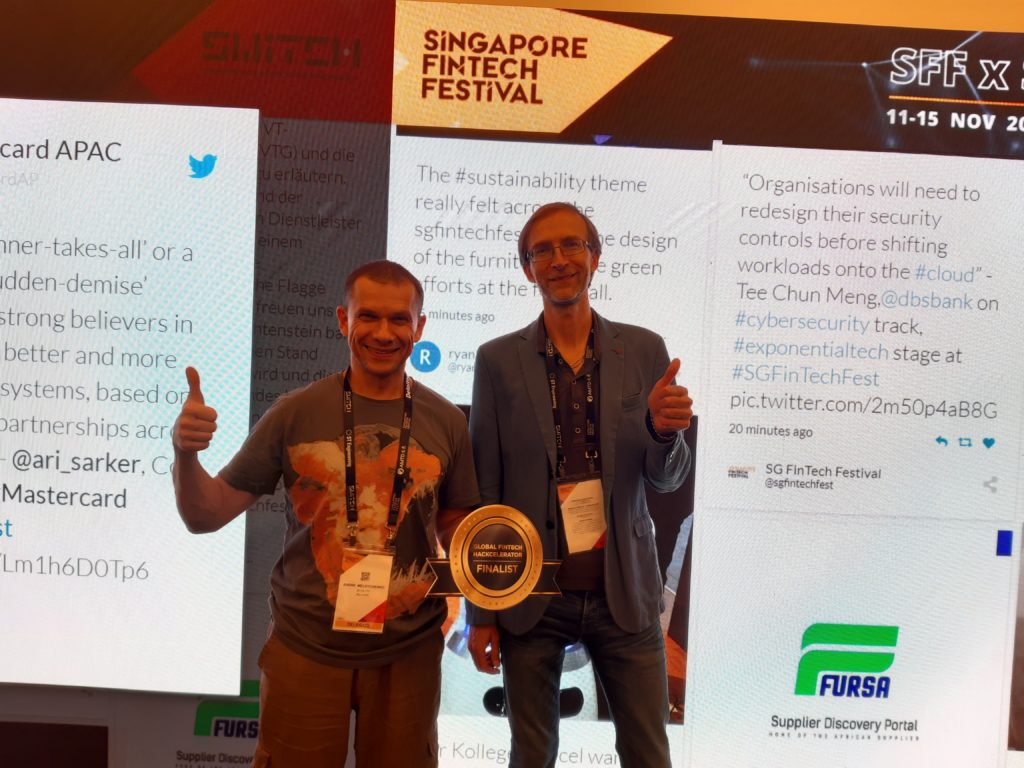

Skyglyph is a Finalist for the 2019 Global FinTech Hackcelerator

As you may be heard, The Monetary Authority of Singapore (MAS) has announced the 20 finalists for the Global FinTech Hackcelerator. And finalists pitched their solutions at the Global FinTech Hackcelerator Demo Day at the 2019 Singapore FinTech Festival x Singapore Week of Innovation and Technology (SFF x SWITCH).

Skyglyph was selected as a finalist of the Global FinTech Hackcelerator. We participated and pitched our agriculture insurance solution on Demo Day, 11th November 2019.

During pitch Victor Yermak, CEO of Skyglyph told that the Asia Pacific agriculture insurance market is huge but ineffective due to lack of data from the ground about crop state and slow data exchange between market players: farmers, insurance and reinsurance companies.

Claim management is the core of commercial insurance. Classical indemnity insurance is obvious but fully manual, and, as a result, slow, imprecise and fraudulent. Index insurance is simply due to using one criterion (for example rainfall level) for compensation to farmers. But it has a low correlation with real damage due to insufficient data quality. In other words, both methods are ineffective.

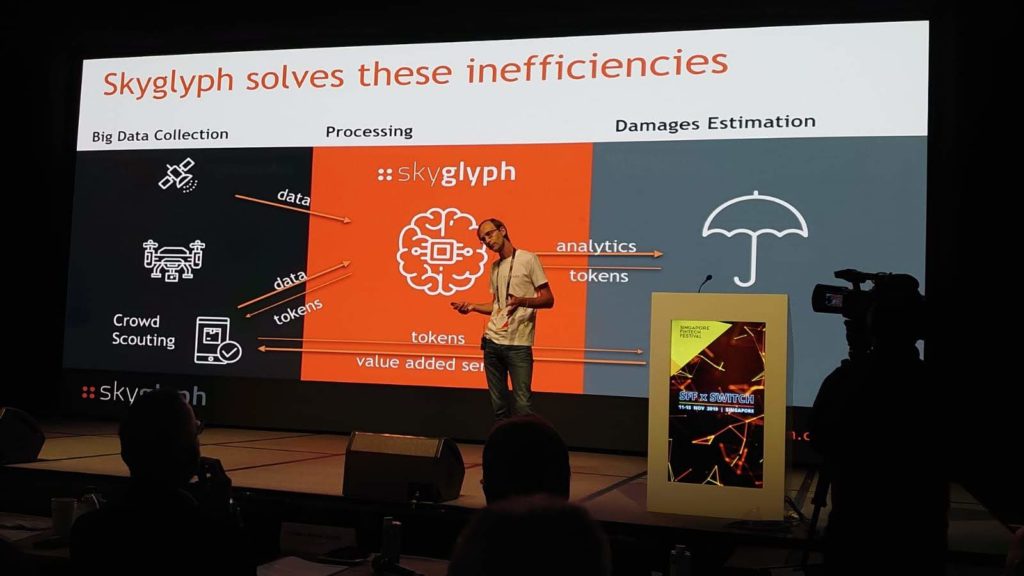

To resolve these inefficiencies, we provide a collaborative platform that streamlines data flow on the whole cycle of claim management. Crowd scouting mechanism involves farmers for data collection with the help of smartphones and drones, awards farmers tokens which they can change for services in the future including insurance companies and suppliers of seeds/chemistry/machinery; then our cloud platform validate these data by ML and prepare analytics for damage estimation; insurer with help of ML can estimate damage very quickly and precisely.

Such an approach accelerates claim adjustments in times, makes compensation quicker and provides trust for all sides.

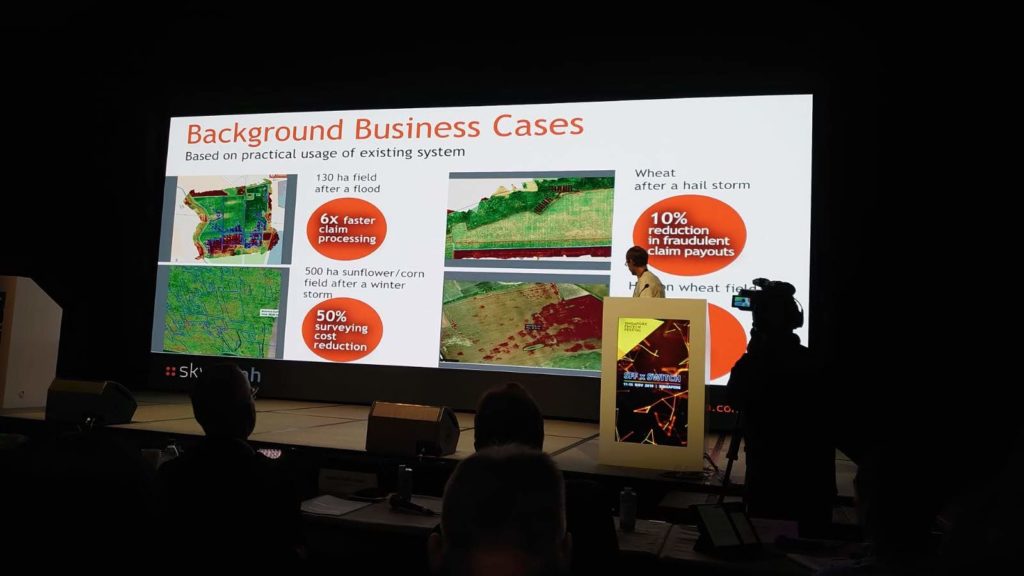

Also, Victor demonstrated a number of business cases, which are based on practical usage of our system, which proves the benefits of system including faster time processing, decreasing cost, save loss payout and elimination of fraud.

In reality, the decision to submit our solution to the Global Fintech accelerator was not spontaneous. Skyglyph has started to work in Southeast Asia two years ago, in 2017, since Skyglyph was awarded as a finalist of Insurtech Award of Award Nominees 2017. Since 2017 Skyglyph has acquired a number of commercial clients in Indonesia and among them Garudafood,- Indonesians leading food and beverages supplier. Garudafood uses the Skyglyph system for crop monitoring and yield estimation of peanuts.

Also, the local Skyglyph Representative and Partner is located in Jakarta.

For the next 3 years, our plans include Launch of CrowdScouting blockchain platform and expand our business into the APAC region.

According to our experience of pitching and participating in the exhibition, the Asian market has a huge interest in such type of solution. Our kiosk was visited by more than 100 potential partners, clients, and industry consultants. The networking atmosphere encouraged us to communicate with other participants of the Festival.