Offering Big Data Analytics & Tech Solution to Farmers & Insurance Companies in India

There are many types of insurances, including index-based insurance, which use satellites photos for measuring some indices (for example NDVI) and reimbursing. But, for many types of risks, payouts from the index-based insurance products are poorly correlated with actual damage experienced by farmers in their fields, resulting in limited uptake and limited impacts. Image resolutions are too small to detect damage on the fields of smallholder farmers. Additionally, clouds, dust and weather conditions do not allow to talk about operative delivering of results or even make the getting such results impossible.

Millions of smallholder farmers in India have been suffering due to inability to monitor damage, poor claim assessment and insurance products which are mainly area based rather than field based. Complexities of a large country with a large number of land holdings of small fields make survey and data collection a huge challenge.

Due to these factors, insurers hardly see the fields of small farmers in the period of underwriting and growing period. It means a high risk of fraud and lack of analytics. Further, loss assessment is also based on a manual survey – which is next to impossible in reality.

To eliminate these shortcomings, Skyglyph and Raman Singh Saluja, founder of Gramco Infratech Pvt Ltd, with on-ground support from a leading Insurance company, have undertaken a pilot project, for drone-based and image processing methodology, which allows for data collection and monitoring. The analytics and data captured will prove to be a game changer for insurance companies, farmers. The concept holds potential to lower reinsurance premiums, quick settlement of claims through bankable scientific and geo-tagged data analytics.

Our service (LARS method – Low Altitude Remote Sensing) is an alternative type of insurance that do not require insurance companies to verify damage on a case-by-case basis.

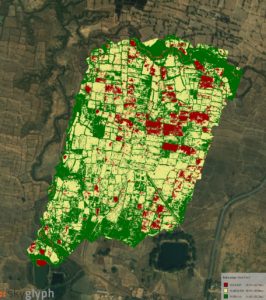

In the general words, Gramco uses drones to cover many smallholders for one flight (see picture below) and collect NDVI information weekly. Insurance companies and farmers are allowed to review this analytical information thought cloud system (Skyglyph) and monitor crop conditions constantly.

With our LARS approach, we overcome limitations of index-based methods, provide aerial drones orthophotos and snapshots from fields with health crop assessment periodically, starting from the underwriting point. We can cover hundreds of small fields for one flight and survey up to 3000 ha per day with one drone. The results (below) usually ready for analysis next day after surveying.

In the more details, insurers and farmers get through our cloud-based system such fruits:

1) visual orthophoto of the fields with resolution up to 2 cm per pixel (in comparison with 5m per pixel from satellites) with given period

2) detailed sample photos from altitude 5-10 m with a resolution about several millimeters per pixel for detailed remote analysis by experts and agronomists

3) VARI index orthomap, which allows to assess the density of crop and compare growth progress historically

4) NDVI index orthomap, which allows assessing chlorophyll activity in the leaves and general health of the crop. Also, historical comparison and progress analysis are possible

The partnership of Skyglyph and Gramco holds huge potential in supporting the Indian government’s vision of doubling farmer income by bringing in transparency, bankability, and speed to the most critical customers of insurance sector – farmers. Gramco is preparing to reach out to the insurance sector for new insurance product development using our learnings and solutions which will enable a wider implementation and adoption of crop insurance products.