Skyglyph turns on consumer drones to the professional crop insurance tool

Crop underwriting and claims auditing are processes that are both time and cost-consuming, and providing assessment manually often leads to inaccurate loss estimates. Existing manual loss adjustment practice time and cost-consuming leaves room for fraud and burn mistrust between farmers and insurance companies.

To facilitate data collection in the field, Skyglyph delivered a tool, which turns on consumer drone into a professional instrument for crop insurance.

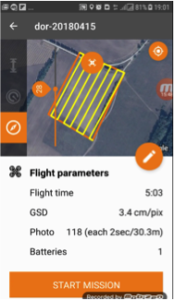

AeroScouter is an Android-based mobile application, which enables management of personal drones for every crop adjuster, even one who had no experience with drones before. At this time application works only with DJI family of drones.

How is whole process works?

At the first step, Claim Adjuster draw border of the field or even establish one point on the map in the our cloud application.

After that, corresponding Mission for field scouting is synchronized with AeroScouter automatically.

Finally, a user in the field can only unpack from the bag a drone, put one on the ground, turn on and press button “Start” in the mobile AeroScouter.

Drone takes off automatically, runs by a special route to collect data for producing of orthophoto and lands without human intervention. Role of human in this process reduces to the verification of airspace security, an absence of obstacles to flight and the transferring of data to the cloud system.

In further, whole data processing and image analysis run by Skyglyph cloud application.

Also, this mobile application is an important step on the way of implementation of Skyglyph vision about uberization of crop insurance. We believe that in a five years horizon, every farmer will be an owner of a drone. In that sense, the mass usage of professional drones in agricultural insurance is inevitably coming. Soon many insurance companies will either develop or employ cloud-based software solutions that would allow them to collect, process, and recognize aerial data. Farmers will exclusively use drones for their crop management, and share their aerial images via the cloud to the insurance companies when weather-related damage occurs. Thus, the insurer will be able to monitor the crops remotely and become aware of issues and risks much earlier than usual, effectively ensuring between two to as much as ten times faster claims resolution process.

The mobile application was developed for Skyglyph by Technorely, the mobile technology partner of Skyglyph. Technorely is a software development and IT outsourcing company in Ukraine, a team of professionals with strong expertise in various industries: fintech, real estate, healthcare, the blockchain, SAP, ERP, geolocation, social, etc.

About Skyglyph. Skyglyph is a software company, focused on optimizing risk assessment and damage measurement in crop insurance and crop science. Our core business is developing cloud software for detection and assessment of crop risks and damages by data, collected from many sources, including drones, satellites, smartphones, and cameras.